Through our partnership with leading Human Capital Management (HCM) technology vendor UKG, formerly Kronos, you can have it ALL without sacrificing on service. Receive a best-in-class solution while still receiving personalized support from GNSA right here in Portland.

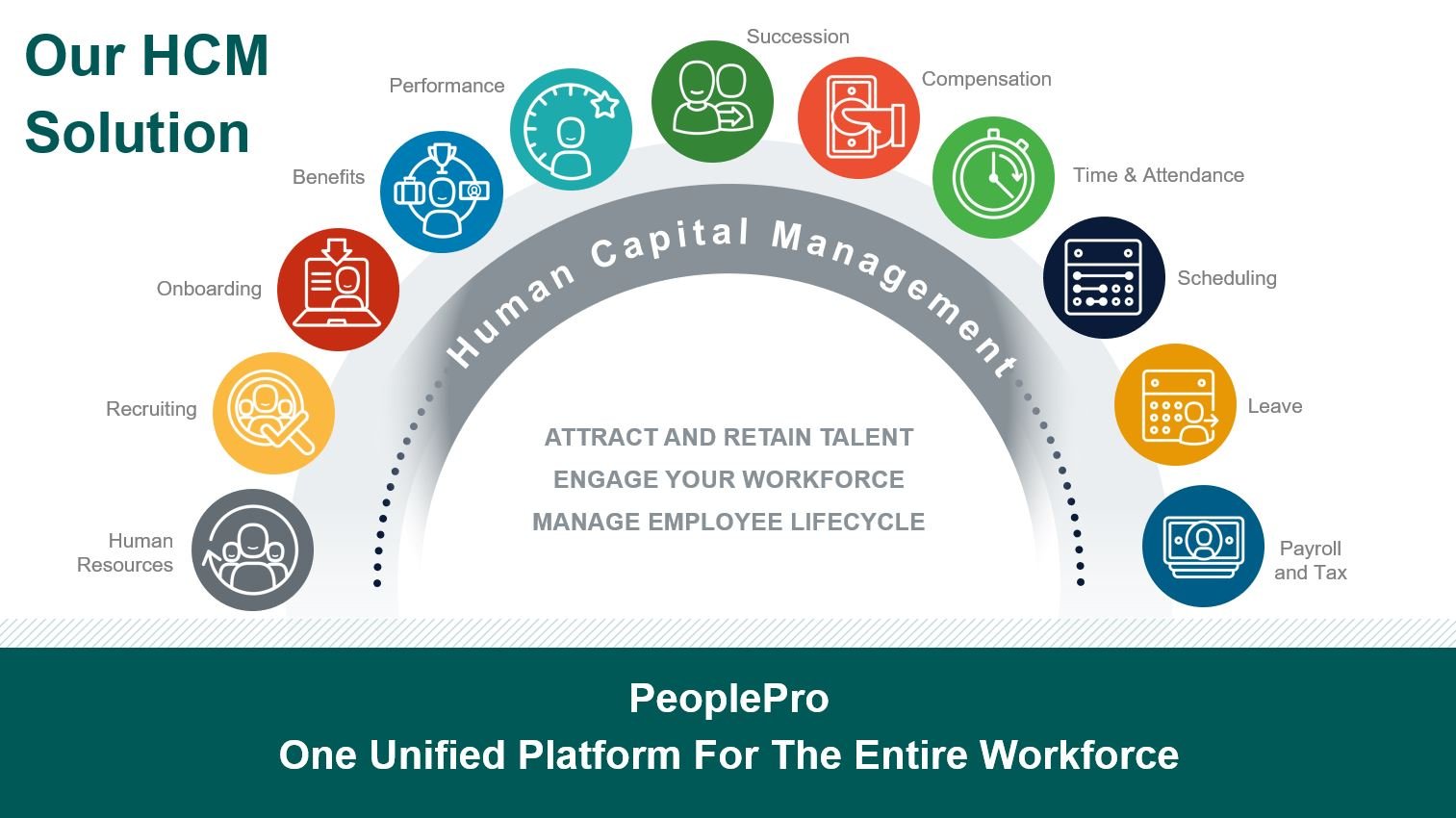

PeoplePro, powered by Kronos, is your HCM solution! Your entire workforce can accomplish daily tasks — from applying for jobs and enrolling in benefits to managing time and tracking performance — with consumer-grade speed and ease.

One Unified People Platform for Your Entire Workforce.

The simplicity of working on one unified platform through PeoplePro means your teams can seamlessly manage your entire workforce from pre-hire to retire.

PeoplePro's automated payroll solutions simplify your payroll processes, empower employees with self-service (ESS) features, and improve paycheck accuracy.

PeoplePro streamlines HR administration and simplifies compliance so you focus on people, not processes. Give your employees the best experience from pre-hire to retire.

PeoplePro simplifies the tedious tasks involved with monitoring employee time and attendance, labor tracking, and data collection with completely automated time-tracking software.

Our Client Services Teams have over 175 years of combined experience with extensive knowledge of our HCM software and all of our products and services.

From the complexity of selecting carriers and delivering employee benefits to the time-consuming task of reconciling monthly invoices and submission of provider data- GNSA has your solution!

GNSA partners with only the most dedicated agencies to provide the best delivery of insurance products to both employers and the people that work for them.

This centralized resource shows how the different features across our human capital management (HCM) solution fit together within a single, unified platform. You can quickly look through to see the full scope of what the platform can do and learn about specific features within each HCM solution and module.

6915 S Macadam Ave

Suite 350

Portland, OR 97219

Phone: 1-503-972-0999

Email: info@gnsadmin.com

MON-FRI 6:00 AM – 5:00 PM PST